Trumps Tariff Turmoil

After much flipflopping around tariff policies in Q1, President Trump announced far-reaching import taxes on “Liberation Day”. They were higher than even the most pessimistic forecasts, with a minimum 10% tariff on all goods imports as well as “reciprocal” tariffs. Taken together they were estimated to push up America’s effective tariff rate to 22% from 2.7% at the end of 2024. Responses across countries differed with some seeking to negotiate while others retaliated with counter tariffs. In the case of China, a number of retaliatory rounds followed, culminating in the tariff on Chinese goods being raised to 145% while China responded by bringing its tax on US imports up to 125%.

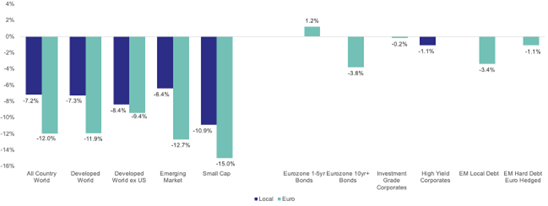

The market reaction was strong and unequivocal. A growth shock was priced in as global equities posted heavy losses, while government bond yields initially fell as central banks were expected to cut rates more aggressively than previously forecast. US bond yields however have begun to rise again in recent days as the Fed suggested it would need to keep policy rates high to combat rising inflation pressures while US budget discussions pointed to sharply rising fiscal deficits. Financial assets exposed to economic growth like credit and oil experienced large falls, reflecting a dimmed demand outlook. The weakness in the US dollar was noteworthy since American tariffs and recession concerns would usually be expected to strengthen the greenback. The move reflected a damaging of the dollar’s safe-haven status, threatening its leadership of the global economy.

There was a sudden reversal on April 9th as President Trump announced a 90-day pause on the “reciprocal” tariffs outlined last week to allow for negotiations and this facilitated some reversal of recent market moves. The S&P rose by 9.5%, the third largest single day rise since World War 2 though as of the close on April 9th it was still down 7.2% year-to-date and was 3.8% below the level immediately before the “Liberation Day” tariff announcements.

Outlook

Uncertainties linked to US trade policy have dominated markets in recent weeks. Lack of clarity regarding their impact on growth, inflation and broad activity levels have contributed to large scale revisions to forecasts with wider than normal ranges around potential outcomes. Low levels of conviction and visibility in these forecasts with the skew of risks being to the downside has contributed to significant swings in markets with risky assets being particularly badly impacted.

The announcement of the 90-day pause in tariffs has provided relief and could mark the beginning of a de-escalation in trade tensions. It helps avoid a worst-case outcome for now and potentially puts a floor in equity markets by providing time for negotiations and the agreeing of deals where tariffs could eventually settle at or much closer to the universal rate of 10% for trading partners excluding China. While such an outcome would still be a drag on growth relative to the end-2024 position, it would be much more benign compared to what was being discounted in markets only a few days ago but investors must wait another 90 days before a potential resolution.

The economic and market outlook is set to remain in a state of flux in the near term as the Trump administration appears intent on disrupting the established order to get a “fairer” deal for America, an approach that has reset trade relations and may lead to challenging trade negotiations. An optimistic take is that “Liberation Day” might mark the start of reimagined trade agreements, potentially leading to creative solutions that are less damaging than a trade war. This murky policy outlook has created a less predictable backdrop for investors and volatility is likely to remain elevated until there is improved clarity.

Client concerns are understandable in times like these but remaining invested is important in order to meet long-term goals. Portfolios that deliver more stable returns through diversification across and within asset classes and investment styles with built-in resilience are an approach likely to generate strong relative investment outcomes against a backdrop of heightened uncertainty.